Unicorn Extinction: Much Ado About Nothing?

If you believe the headlines, private investors are in for a rough year. Spurred on by a weak stock market, lackluster IPO performance and technology companies selling for less than paid-in-capital, media outlets are proclaiming a massive extinction of the so-called “unicorns”.

Although markets are known to have a mercurial temperament, I’m constantly amazed by the emotional volatility created by the 24-hour news cycle.

Frankly, a decline in unicorn valuations isn’t all that surprising or concerning.

First of all, although people have been debating a “tech bubble” for the last few years, it’s largely been a false dichotomy for the private investor, whose economics often have very little to do with the overall equity value of the entity. Some have gone as far as saying that “private valuations are fake”.

While that sentiment may be a bit hyperbolic, it’s definitely true that liquidation preferences, ratchets and other downturn protections mean that the implied common stock valuation of a company often has little bearing on the true economic value to its early-stage private investors. But as these companies move towards a liquidity event, it’s only natural to assume that their values will “correct” to a level that more appropriately reflects the value of common ownership.

Second, private markets generally create an asymmetric balance of supply and demand. Demand for high-growth technology stocks has been intense, yet access has been limited as opportunities to invest in these entities has been restricted to a select group of angels, venture capitalists and well-connected crossover investors. The inevitable endgame of the venture cycle – the potential IPO of the 157 unicorns currently worth over $0.5 trillion – was bound to spawn a deluge of supply that put downward pressure on asset prices.

Finally, and perhaps most importantly, a price correction shouldn’t alarm investors as stock market fluctuations, VC funding cycles and “gloom and doom” reporting have little to no impact on long-term value creation.

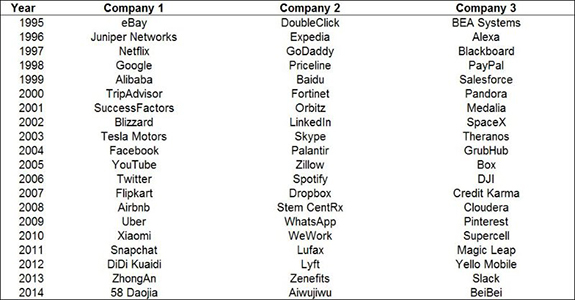

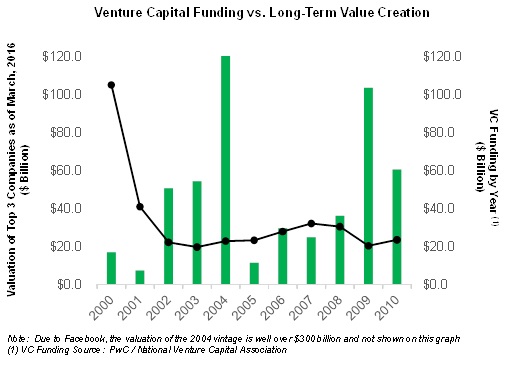

To help illustrate this last point, we worked with David Bochetto of Chicago’s Booth School of Business to identify the three most valuable companies created in each year for the past 20 years. What we found was very interesting:

- At least three $1B+ companies have been founded every year for the past 20 years

- VC funding cycles have little to do with the ultimate value of firms founded in a given year – 2000 saw the highest influx of venture capital ($105B according to a report by PwC and the National Venture Association) yet was one of the worst vintages for value creation. 2004 and 2009 were relatively modest years for funding, but saw the creation of Facebook, Palantir, Uber, WhatsApp and Pinterest

- There’s no correlation between yearly stock market returns and long-term value creation: comparing the current valuation of the top 3 firms in each founding vintage to the corresponding yearly NASDAQ return yields an R^2 value of close to 0.

The Bull Case for Unicorn Hunting

Indeed, it seems that the old cliché that “the best companies are born in downturns” has merit (or, at the very least, the strongest companies are unaffected by them).

As such, we believe that the current bearish sentiment couldn’t come at a better time. There are undoubtedly several unicorns that are creating substantial economic value, and cooling markets should lead to stronger business fundamentals.

Investment Theme #1: Creation of substantial economic value

When you step back a bit from the day-to-day swings of the market and the 24 hour news cycle, we believe that one clear trend becomes apparent: we are in the early stages of an economic paradigm shift driven by globalization and technology. Klaus Schwab, founder of the World Economic Forum, explained to the participants at Davos this year that we are at the precipice of a “fourth industrial revolution” that “is unlike anything humankind has experienced before”.

Breakthroughs in fields such as artificial intelligence, robotics, the Internet of Things, autonomous vehicles, cryptocurrency, 3-D printing, nanotechnology, biotechnology, materials science, energy storage, and quantum computing are evolving at an exponential rate and generating utility throughout the value chain.

And then there’s the human angle. The possibilities of billions of people connected by mobile devices, with unprecedented processing power, storage capacity and access to knowledge are unlimited. What could Srinivasa Ramanujan have done with an iPhone?

Put these two together and you have a virtuous cycle arising from a vertically networked and horizontally integrated world. In short, smarter people make better technologies which in turn make even smarter people.

So when you put the valuation issue aside, it’s hard to argue that the unicorns aren’t driving an unprecedented paradigm shift.

After all, as TechCrunch pointed out over a year ago: “Uber, the world’s largest taxi company, owns no vehicles. Facebook, the world’s most popular media owner, creates no content. Alibaba, the most valuable retailer, has no inventory. And Airbnb, the world’s largest accommodation provider, owns no real estate. Something interesting is happening.”

Investment Theme #2: Increased focus on long-term unit economics and profitability

Unfortunately, the current Silicon Valley zeitgeist seems to be that it’s somehow “short-sighted” to focus on anything other than raw growth. Companies such as Facebook, Twitter, Dropbox, LinkedIn and Pinterest cast a large shadow as role models for the grow-first, monetize-later strategy. When capital seems unlimited, high cash-burn rates are seen as little more than a nuisance for the accounting team to monitor.

Excluding a few high-profile exceptions, this is generally a recipe for failure. In ananalysis of over 100 startup post-mortems, CBInsights found that over 70% of startups attributed their collapse to running out of cash or realizing that there was no market need (i.e. their vast user-base wasn’t actually willing to pay for the product).

Fortunately, lean times often force management to reassess their priorities, and a renewed focus on long-term unit economics, frugal management and profitability can only benefit investors.

To the extent that the latest generation of startup founders learns the same lesson and starts to refocus on the fundamentals, it’s a win for prospective investors.

When There’s Blood on the Streets…

To understand the current investor sentiment, one needs to look no further than a recentsurvey of over 150 VCs that found that “more than 90% of respondents expected valuations to go down in 2016 with a full 1/3rd of investors expecting significant price corrections.” Furthermore, 82% of VCs expressed concerns about 2016 and 85% predicted that funding would be flat to down.

While these apprehensions may be daunting to some, we believe that they represent a strong opportunity as positive long-term macroeconomic trends and increased focus on short-term fundamentals provide a solid foundation of value for the patient investor.

Given that there are certainly great companies in the universe of 157 unicorns – firms with enormous market potential, established competitive positions and visionary and methodical management – we’re confident that a disciplined investment strategy will continue to yield the potential for enormous risk-adjusted returns.