When Covid-19 first reached the U.S. and businesses rapidly began to shut down, investors braced for the worst. Venture capitalists (VCs) put out messages to founders to shore up their balance sheets and prepare for a funding nuclear winter.

Running A Startup Through The Eyes Of A Poker Player

Photo Credit: Indivisible Game

To pass the time during the Covid-19 lockdown, I taught my kids how to play poker. I'm no expert, but I play occasionally and understand the game well. As I walked them through the fundamentals, I started thinking about the similarities between playing poker and running a startup. The skills you need and the mindset you have to develop are similar in both, and as a founder, that's likely what drew me to poker in the first place.

Why Pivoting Is A Good Thing

Most companies begin the same way. The founders have an idea, and they research it, validate it and build it. In a dream world, what they build turns into a successful company right away, without the need for a pivot. Every founder would “get it right” from the beginning.

Deploying Capital? 16 Tips To Help You Make The Best Decision For Your Business

Effectively leveraging capital is one of the most important—and potentially difficult—decisions for business owners and leaders. While many businesses may have long wish lists, it’s important to carefully target investments that can bring real ROI—as well as to decide if now is even the right time for expenditure of any kind.

In A Crisis, Don’t Lead By Consensus

Before I shifted my focus to private markets in 2012, I spent nearly 20 years as a public markets investor and built three hedge funds. My career spanned some of the difficult economic crises in recent memory, including the Great Recession that led to the loss of more than $2 trillion in global economic growth.

How The Global Pandemic Exposed The Fault Lines In Our World

The spiky little virus known as Covid-19 attached itself to our lives and ended what was our old version of normal. This pandemic has halted life as we knew it, laying bare the structural inequities of our society. Healthcare, government, education and the economy — pillars we relied on — began to crack under the pressure of a society relying on them to uphold the very foundation upon which we rest.

Why the Next Unicorns May Not Come from Silicon Valley

Peruse the headlines, and you’ll find hundreds of articles predicting the “next Silicon Valley.” Pundits claim that the growing cost of living in the Bay Area is driving businesses away to more affordable regions that are rich in tech talent such as Austin, Phoenix, Boulder, and Miami.

But try as they might, these “hubs” won’t ever beat Northern California at its own game – the area will continue to dominate information technology because of its unique arbitrage of thought, culture and research.

But that’s okay, because striving to replicate the success of the Bay Area limits us by imposing an arbitrary constraint on our imagination. After all, does Silicon Valley represent the pinnacle of success in human innovation, or are there regions that have the potential to evolve into something even greater?

Read the rest of the article on Business Insider...

Photo Credit: The Tichnor Brothers Collection at The Boston Public Library on Flickr.com

Why Spies Make the Best Entrepreneurs

The New Yorker once called Stanford “a giant tech incubator with a football team”. Although the publication clearly intended this as an insult, it’s also an ode to the dominance that Harvard and Stanford have held over Silicon Valley in the last few decades. Alumni of these institutions have founded an impressive list of companies including Facebook, Instagram, PayPal, Google, Netflix, LinkedIn and Snapchat.

But does that mean that Harvard and Stanford are the best training ground for entrepreneurs?

Maybe not, because there's a secret source overseas that's producing some of the best tech talent in the world...

Read the full article on Business Insider.

Photo Credit: © Feng Yu | Dreamstime.com

The Unlikely Heirs to the Dollar Shave Club Crown

Dollar Shave Club’s recent $1 billion acquisition by Unilever came as a surprise to many, as consumer products companies have long been shunned by the venture community due to high capital requirements, low multiples and margin pressure from online retailers.

While many startups following Dollar Shave Club’s lead are doomed to fail, we believe we have identified a handful that may have the impetus to flourish…

Read the full article on Business Insider.

Photo Credit: © Konstantin Kirillov | Dreamstime.com

The Myth of the Uber Monopoly

When top 3 player Sidecar closed earlier this year and sold its assets to GM, many pronounced the ride-sharing wars over and the prevailing wisdom seemed to suggest that Uber was destined to become a monopoly.

But recent multi-billion dollar investments in Lyft and Didi Chuxing have challenged that perception and caused many to wonder whether this market has room for more than one player…

The Silicon Valley Argument

An article written earlier this year in the New Yorker argues that industries driven by technology can’t support multiple players, and that competition in Silicon Valley trends toward one monopolistic winner.

The primary reason for this stems from the economics of network effects – a phenomenon where the value of a product or service increases with the number of people using it. Network effects are seen in companies such as Facebook, eBay and Skype; all virtual monopolies in their field.

A second reason for the existence of internet monopolies can be found in the economics of zero marginal cost distribution – a situation where an additional good or service can be produced without any increase in total cost. With the exception of the minimal cost of increased bandwidth, it’s largely free for Google or Snapchat to host another user.

Together, these two forces create a virtuous cycle. Once a service becomes popular, it creates additional consumer demand. Since the cost of distribution is largely zero, it’s easy to attract and onboard new customers to the service. These additional users make the offering more valuable and, in turn, attract even more users. This cycle continues and makes the internet a breeding ground for unfair competition.

When it comes to technology companies, law professor Tim Wu explains: “over the long haul, competition has been the exception, monopoly the rule”. That’s why we see so many near monopolies in the space, such as Facebook, Google, Wikipedia, LinkedIn, Craigslist, Amazon and Twitter. Indeed, at first glance, it seems that technology industries may be “winner-takes-all” markets.

This view is likely a large part of the reason that Uber is valued at 12x more than its nearest competitor Lyft, despite only having 4x the revenue.

The Emerging Counterpoint

With recent investments in Lyft and Didi Chuxing totaling over $2 billion, it seems like investors aren’t ready to throw in towel yet, and that’s probably wise given that there are two key faults underpinning the “winner-takes-all” theory discussed above.

As pointed out in this article on Quartz, the first mistake is not understanding that there are two different types of “network effects”.

The first is known as a “demand-side network effect”. In a demand-side network effect, the value of a product or service is directly increased by each additional user solely due to the addition of that user. Facebook is the perfect example of this – you join Facebook because all of your friends are on there. From an economic point of view, demand-side network effects are a game-changer, as even a small competitive lead can rapidly snowball into an entrenched competitive advantage.

The other type of network effect is known as a “supply-side network effect”. In a supply-side network effect, increased usage of a product or service has no influence on the direct utility for users, but it spawns the production of valuable complimentary goods and services. A great example of this can be seen with cell phone carriers. The more users a carrier has, the more money they can afford to spend on infrastructure. The better the infrastructure, the better the quality of service. In this case, the number of users is indirectly influencing the customer’s choice: although people may not join a carrier because their friends are on there, they are likely to join the carrier with the best service.

And that’s the case with Uber. The company’s competitive advantage largely stems from the number of drivers they have on the road and the number of cities they operate in. Both of these are supply-side benefits.

But while supply-side network effects definitely have their advantages, this is not a competitive edge that can’t be overcome. In this particular case, the way to challenge it is by purchasing scale – attracting more drivers, opening in more cities, etc...

With $2 billion in funding to date, that’s exactly what competitors such as Lyft are doing.

Indeed, Lyft President John Zimmer agrees that, “in a transportation business, specifically our business, there are very strong network effects, but only to a point.” Specifically, Zimmer found that “once you hit three minute pickup times, there's no benefit to having more people on the network."

The second mistake in the “winner-takes-all” theory is that, unlike many technology companies, Uber does not experience zero marginal cost distribution. While it is true that the company’s business model has eliminated a lot of the costs associated with a traditional taxi business, such as vehicles and vehicle maintenance, licenses, insurance, gas and driver compensation and benefits, there are costs to distribution that still exist.

Taking a look at Uber’s leaked financials, we see that in the second quarter of 2014 they listed $49 million in “cost of revenue” and “operations and support” against $57 million of revenue. Traditional accounting standards would assume that these are variable costs, which are separate from the additional $115 million in “fixed costs” of sales and marketing, R&D and general overhead.

While the document doesn’t break out expenses by line item, it’s easy to speculate that a large portion of these costs are directly tied to the expansion of their service offering. For instance, each time Uber launches in a new city, it has to create a local team to deal with the particular politics, regulations and consumer preferences of that environment. Uber also likely experiences substantial costs in the acquisition of new drivers, including marketing, incentives and bonuses, and screening and background checks. Finally, Uber now provides insurance to its drivers, and there’s a cost to that as well.

And if rulings such as the one in California - where a judge determined that an Uber driver was, in fact, an employee – gain national traction, then distribution costs could skyrocket. According to some analysts, offering health insurance, unemployment, worker’s compensation, payroll taxes, 401K, vacation time and reimbursement for miles, gas and tolls, could raise distribution costs by an order of magnitude, and cost the company an additional $13K per driver (or $4.1 billion per year).

So while zero marginal cost distribution is a key ingredient in the recipe for making a tech monopoly, it simply doesn’t exist in the ride-sharing industry.

In summary, investors are beginning to realize that the Silicon Valley view that ride-sharing is a “winner-take-all” market is flawed for two reasons: 1) the absence of demand-side network effects and 2) tangible marginal costs to distribution.

But Uber Has the Potential to be So Much More Than a Taxi-Service!

Some Silicon Valley pundits will argue that focusing on ride-sharing is myopic, and that Uber will evolve into an all-purpose “tech utility” that will re-ignite the virtuous cycle of network effects and pave the way to global domination.

For instance, many insiders believe that Uber can create a full service “urban logistics fabric” and completely own the coveted “last mile” of distribution. With services such as UberRUSH (courier), UberEATS (food delivery) and UberCargo (moving), the company seems to be heading in this direction.

But even if Uber is able to realize its dream of owning the “intersection of lifestyle and logistics”, does this change the underlying economics?

Would Uber instantly gain demand-side network effects? Most people don’t care who delivers their packages, as long as they get there on time. So that leaves us where we started…there are advantages to scale, but they come from the supply side. And given that incumbents such as FedEx and UPS have both experience in this market AND scale, competition might not disappear as quickly as some Uber bulls would have you think. As FedEx CEO Fred Smith says “I think there’s just an urban mythology that [Uber] somehow changes the basic cost input of the logistics business”.

Would Uber instantly gain zero marginal cost distribution? No, it would face the same costs as discussed above.

Others believe that the emergence autonomous cars will hold the key to monopolistic power, but even that isn’t the panacea that some hold it out to be. If Uber continues on the path it seems to be heading now and takes ownership of these assets, then costs would likely increase. Even if it take the road that Lyft is travelling, and outsources the car ownership to someone else, there are still costs that are going to present themselvessomewhere in the value chain. In parlance popularized by Milton Friedman, there’s “no free lunch” and delivery via any type of vehicle – even a solar powered self-driving one – is the exact opposite of zero marginal cost distribution.

If anything, as Uber aims to expand beyond its current offerings, competitors will have the time and space to perfect their own logistical framework and establish an advantage in the areas the Uber misses. Whether that’s FedEx, UPS, Instacart, Deliv, Amazon or Lyft is largely irrelevant – what matters is that there’s still room for competition.

In short, the maturation of technology and proliferation of options should serve as an opportunity for more players to enter the industry, not fewer.

Valley Value Investing?

When Uber changed its slogan from “everyone’s private driver” to “where lifestyle meets logistics” it undoubtedly did so to position itself as a “technology company” that, like Facebook, LinkedIn, and Twitter, could easily dominate its market with the virtuous cycle of network effects.

But let’s get serious for a second: It’s 2016, EVERY company with a chance of long-term success is, in one way or another, a “technology company”. If you’re not leveraging technology, you’re already dead.

So while the market for ride-sharing and logistics may have evolved to the point where it’s no longer strictly analog (i.e. it probably won’t experience the same level of competition that we’ve historically seen in hotels, airlines and / or rental car companies), it’s not strictly “digital” either. As long as the network effects remain on the supply-side, as long as there are costs to expansion and as long as the threat of regulation remains, then it’s unlikely that Uber will ever become a true monopoly in the way that some Silicon Valley insiders hope.

Indeed, as John Zimmer points out, Lyft is “gaining share in all top 20 markets” and that’s not what happens when one player has a complete monopoly.

So given all of this potential competition – the fact that both the ride-sharing and logistics market can likely support multiple competitors, where does that leave Uber? Is it worth the $70 billion price tag?

Well, I won’t opine on this right now, but what I will say is that a lot of its investors, and even the notoriously conservative NYU professor Aswath Damodoran, seem to think so.

But perhaps the more important question in all of this is the following: if you believe that Uber is fairly valued (or at least close to it), then why are Lyft, Ola, Didi Chuxing and GrabTaxi valued so low?

After all, these companies are all building a similar infrastructure, and Lyft controls over 40% of the market in Uber’s home turf of San Francisco and has a fourth of the revenues of Uber at 1/12th of the valuation; Didi Chuxing claims to control over 87% of the lucrative Chinese market and has 1/3rd of the valuation of Uber; and Ola claims 80% of the Indian market and has a value similar to Lyft.

Given these discrepancies, perhaps old-school value investing has a place in Silicon Valley after all…

Disclaimer: Tiller Partners does NOT hold a position in any of the aforementioned companies.

Hunting for Unicorns

Unicorn Extinction: Much Ado About Nothing?

If you believe the headlines, private investors are in for a rough year. Spurred on by a weak stock market, lackluster IPO performance and technology companies selling for less than paid-in-capital, media outlets are proclaiming a massive extinction of the so-called “unicorns”.

Although markets are known to have a mercurial temperament, I’m constantly amazed by the emotional volatility created by the 24-hour news cycle.

Frankly, a decline in unicorn valuations isn’t all that surprising or concerning.

First of all, although people have been debating a “tech bubble” for the last few years, it’s largely been a false dichotomy for the private investor, whose economics often have very little to do with the overall equity value of the entity. Some have gone as far as saying that “private valuations are fake”.

While that sentiment may be a bit hyperbolic, it’s definitely true that liquidation preferences, ratchets and other downturn protections mean that the implied common stock valuation of a company often has little bearing on the true economic value to its early-stage private investors. But as these companies move towards a liquidity event, it’s only natural to assume that their values will “correct” to a level that more appropriately reflects the value of common ownership.

Second, private markets generally create an asymmetric balance of supply and demand. Demand for high-growth technology stocks has been intense, yet access has been limited as opportunities to invest in these entities has been restricted to a select group of angels, venture capitalists and well-connected crossover investors. The inevitable endgame of the venture cycle – the potential IPO of the 157 unicorns currently worth over $0.5 trillion – was bound to spawn a deluge of supply that put downward pressure on asset prices.

Finally, and perhaps most importantly, a price correction shouldn’t alarm investors as stock market fluctuations, VC funding cycles and “gloom and doom” reporting have little to no impact on long-term value creation.

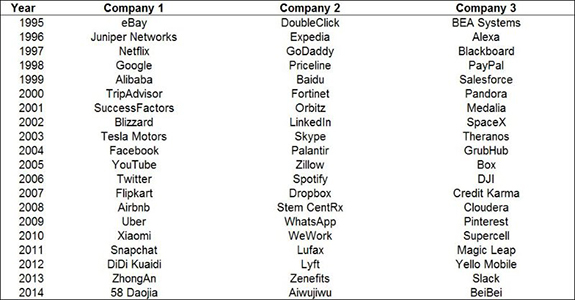

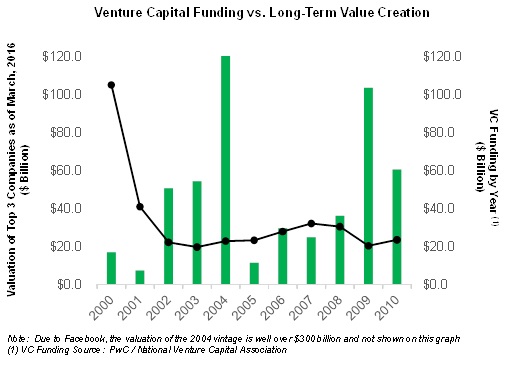

To help illustrate this last point, we worked with David Bochetto of Chicago’s Booth School of Business to identify the three most valuable companies created in each year for the past 20 years. What we found was very interesting:

- At least three $1B+ companies have been founded every year for the past 20 years

- VC funding cycles have little to do with the ultimate value of firms founded in a given year – 2000 saw the highest influx of venture capital ($105B according to a report by PwC and the National Venture Association) yet was one of the worst vintages for value creation. 2004 and 2009 were relatively modest years for funding, but saw the creation of Facebook, Palantir, Uber, WhatsApp and Pinterest

- There’s no correlation between yearly stock market returns and long-term value creation: comparing the current valuation of the top 3 firms in each founding vintage to the corresponding yearly NASDAQ return yields an R^2 value of close to 0.

The Bull Case for Unicorn Hunting

Indeed, it seems that the old cliché that “the best companies are born in downturns” has merit (or, at the very least, the strongest companies are unaffected by them).

As such, we believe that the current bearish sentiment couldn’t come at a better time. There are undoubtedly several unicorns that are creating substantial economic value, and cooling markets should lead to stronger business fundamentals.

Investment Theme #1: Creation of substantial economic value

When you step back a bit from the day-to-day swings of the market and the 24 hour news cycle, we believe that one clear trend becomes apparent: we are in the early stages of an economic paradigm shift driven by globalization and technology. Klaus Schwab, founder of the World Economic Forum, explained to the participants at Davos this year that we are at the precipice of a “fourth industrial revolution” that “is unlike anything humankind has experienced before”.

Breakthroughs in fields such as artificial intelligence, robotics, the Internet of Things, autonomous vehicles, cryptocurrency, 3-D printing, nanotechnology, biotechnology, materials science, energy storage, and quantum computing are evolving at an exponential rate and generating utility throughout the value chain.

And then there’s the human angle. The possibilities of billions of people connected by mobile devices, with unprecedented processing power, storage capacity and access to knowledge are unlimited. What could Srinivasa Ramanujan have done with an iPhone?

Put these two together and you have a virtuous cycle arising from a vertically networked and horizontally integrated world. In short, smarter people make better technologies which in turn make even smarter people.

So when you put the valuation issue aside, it’s hard to argue that the unicorns aren’t driving an unprecedented paradigm shift.

After all, as TechCrunch pointed out over a year ago: “Uber, the world’s largest taxi company, owns no vehicles. Facebook, the world’s most popular media owner, creates no content. Alibaba, the most valuable retailer, has no inventory. And Airbnb, the world’s largest accommodation provider, owns no real estate. Something interesting is happening.”

Investment Theme #2: Increased focus on long-term unit economics and profitability

Unfortunately, the current Silicon Valley zeitgeist seems to be that it’s somehow “short-sighted” to focus on anything other than raw growth. Companies such as Facebook, Twitter, Dropbox, LinkedIn and Pinterest cast a large shadow as role models for the grow-first, monetize-later strategy. When capital seems unlimited, high cash-burn rates are seen as little more than a nuisance for the accounting team to monitor.

Excluding a few high-profile exceptions, this is generally a recipe for failure. In ananalysis of over 100 startup post-mortems, CBInsights found that over 70% of startups attributed their collapse to running out of cash or realizing that there was no market need (i.e. their vast user-base wasn’t actually willing to pay for the product).

Fortunately, lean times often force management to reassess their priorities, and a renewed focus on long-term unit economics, frugal management and profitability can only benefit investors.

To the extent that the latest generation of startup founders learns the same lesson and starts to refocus on the fundamentals, it’s a win for prospective investors.

When There’s Blood on the Streets…

To understand the current investor sentiment, one needs to look no further than a recentsurvey of over 150 VCs that found that “more than 90% of respondents expected valuations to go down in 2016 with a full 1/3rd of investors expecting significant price corrections.” Furthermore, 82% of VCs expressed concerns about 2016 and 85% predicted that funding would be flat to down.

While these apprehensions may be daunting to some, we believe that they represent a strong opportunity as positive long-term macroeconomic trends and increased focus on short-term fundamentals provide a solid foundation of value for the patient investor.

Given that there are certainly great companies in the universe of 157 unicorns – firms with enormous market potential, established competitive positions and visionary and methodical management – we’re confident that a disciplined investment strategy will continue to yield the potential for enormous risk-adjusted returns.